27+ Mortgage and tax calculator

Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. For taxpayers who use married filing separate status the.

Image Result For Tax Client Interview Form Card Template Excel Templates Templates

The calculator is mainly intended for use by US.

. If you are unsure of how to calculate mortgage tax on a modification it is best to contact our office for assistance. If you want to calculate your monthly mortgage payment manually or simply understand how its calculated use this formula. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Use this calculator to see how this deduction can create a significant tax. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. Our calculator includes amoritization tables bi-weekly savings.

Taxpayers can deduct the interest paid on qualified residences for up to 750000 in total mortgage debt the limit is 375000 if married and filing separately. Use this calculator to see how this deduction can create a significant. Original or expected balance for your mortgage.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Any interest paid on first second or home equity mortgages over this amount is not tax-deductible. Mortgage Tax Savings Calculator.

View or Pay Tax Info Mortgage Tax Calculator. This calculator assumes that your itemized deductions will exceed the standard deduction for your income tax filing status. The interest paid on a mortgage along with any points paid at closing are tax deductible if you itemize on your tax return.

2022 Resale Info Packet June 12 Detail List 2022 Excess Resale List Other Links. This calculator estimates your tax savings after a house purchase. Use this calculator for Tulsa County properties only.

Mortgage Tax Calculator. Mortgage Tax Benefits Calculator. Mortgage Tax Savings Calculator Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home insurance and HOA fees. Accepted Format for Date. One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes.

View or Pay Tax Info Mortgage Tax Calculator. Financial analysis is provided for an initial period selected by the user. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Mortgage Cover Sheet Feb21 0. Please note that in addition to the 750000 mortgage debt limit.

Annual effective interest rate after taxes are taken into account. If your mortgage closed before December 15th 2017 the mortgage. Please note that if your mortgage closed on or after December 15th 2017 the mortgage tax deduction is limited to 750000 in mortgage amount.

The interest paid on a mortgage along with any points paid at closing are tax deductible if you itemize on your tax return. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. Please call 9185965053 for assistance.

The interest paid on a mortgage along with any points paid at closing are tax deductible if you itemize on your tax return. Use this calculator to see how this deduction can create a significant. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

Check out the webs best free mortgage calculator to save money on your home loan today. Because there may be prior mortgage tax payments increases in money or other factors to take into consideration you may not be able to use the calculation methods indicated above. If you have a modification that needs to be calculated for another county contact that county directly.

MP r 1rn 1rn-1 M the total monthly mortgage payment. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Interest rate after taxes.

To calculate the total due to the Treasurer for a first modification amendment or extension of a prior mortgage click on the first modification link. Bidder Packet Cty Owned Property Excess List.

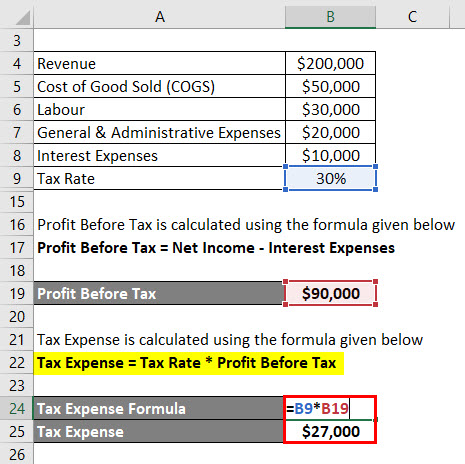

Tax Shield Formula How To Calculate Tax Shield With Example

27 Calculator Pictures Download Free Images On Unsplash

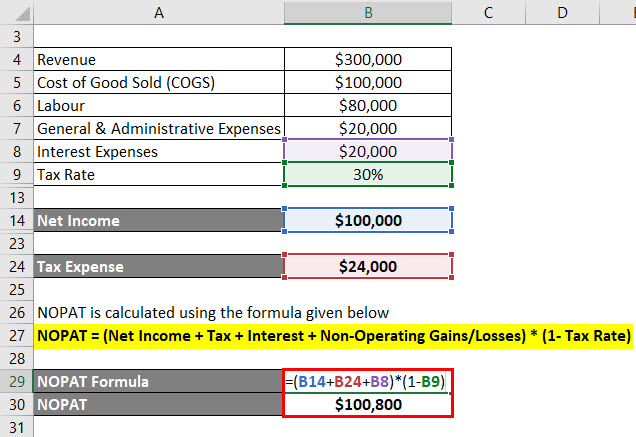

Nopat Formula How To Calculate Nopat Excel Template

27 Sponsorship Proposal Template Sample Letter Sponsorship Proposal Template Seo Marketing Sponsorship Proposal Event Sponsorship Donation Letter

27 Acres Ravenna Road Chardon Oh 44024 Compass

Debt Management Powerpoint Template

Download Excel Sheet To Make Cost Estimation Of Rcc Building Construction Estimating Software Construction News Construction

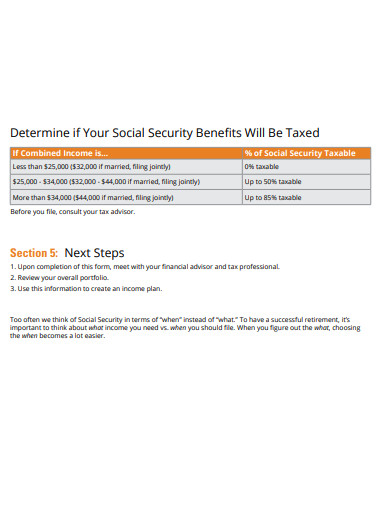

11 Social Security Income Calculator Templates In Pdf Free Premium Templates

Free 27 Printable Client Information Sheet Templates Real Estate Forms Real Estate Client Real Estate Tips

Excel Weekly Home Budget How To Create An Excel Weekly Home Budget Download This Excel Weekly Home Budg Budget Template Excel Budget Template Weekly Budget

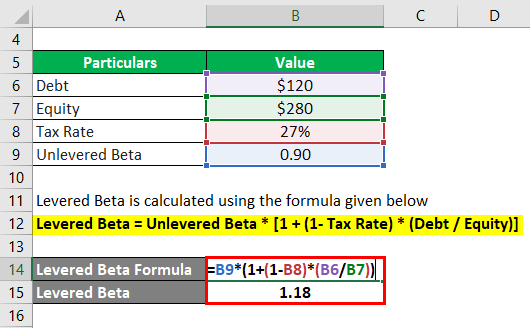

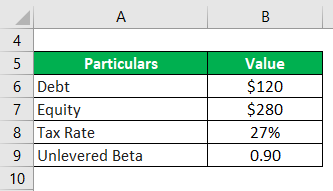

Levered Beta Formula Calculator Examples With Excel Template

27 Calculator Pictures Download Free Images On Unsplash

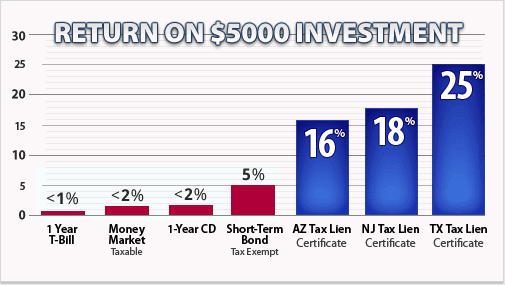

Free Tax Lien Traning Us Tax Lien Association

O Rb8uqdjtsksm

Nopat Formula How To Calculate Nopat Excel Template

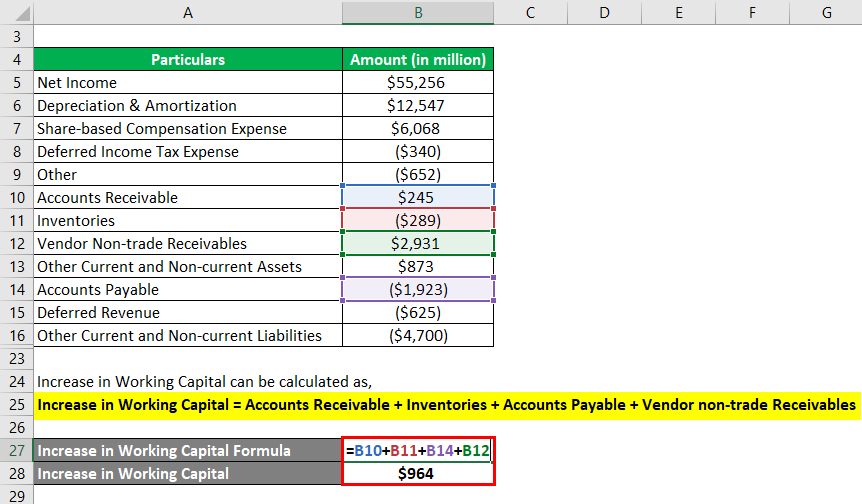

Operating Cash Flow Formula Examples With Excel Template Calculator

Levered Beta Formula Calculator Examples With Excel Template